The smart Trick of Virtual Cfo In Vancouver That Nobody is Discussing

Wiki Article

The Best Strategy To Use For Vancouver Accounting Firm

Table of ContentsFacts About Vancouver Tax Accounting Company RevealedNot known Facts About Cfo Company VancouverThe Buzz on Virtual Cfo In VancouverSee This Report on Vancouver Accounting Firm10 Easy Facts About Pivot Advantage Accounting And Advisory Inc. In Vancouver ExplainedThe Buzz on Tax Accountant In Vancouver, Bc

Below are some benefits to working with an accounting professional over a bookkeeper: An accounting professional can give you a thorough view of your organization's financial state, in addition to strategies as well as suggestions for making economic decisions. On the other hand, bookkeepers are just in charge of recording economic deals. Accountants are called for to complete even more schooling, accreditations and also work experience than bookkeepers.

It can be tough to gauge the suitable time to employ an audit professional or accountant or to determine if you need one at all. While numerous small companies employ an accounting professional as a specialist, you have several alternatives for managing economic tasks. Some little business proprietors do their very own accounting on software program their accounting professional suggests or makes use of, offering it to the accounting professional on an once a week, monthly or quarterly basis for action.

It might take some history study to locate an ideal bookkeeper since, unlike accountants, they are not called for to hold a professional certification. A solid recommendation from a relied on coworker or years of experience are essential variables when working with an accountant. Are you still not exactly sure if you require to hire someone to assist with your publications? Here are three instances that indicate it's time to hire a financial expert: If your tax obligations have become as well complicated to take care of by yourself, with several income streams, foreign financial investments, numerous deductions or other considerations, it's time to hire an accountant.

Not known Details About Small Business Accounting Service In Vancouver

For local business, experienced cash money monitoring is an essential aspect of survival and also development, so it's important to collaborate with a financial expert from the beginning. If you choose to go it alone, think about beginning with audit software program and maintaining your publications meticulously as much as day. This way, need to you require to employ an expert down the line, they will have exposure right into the full economic background of your organization.

Some source meetings were conducted for a previous variation of this article.

How Pivot Advantage Accounting And Advisory Inc. In Vancouver can Save You Time, Stress, and Money.

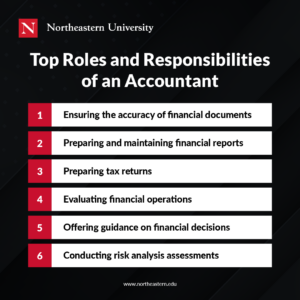

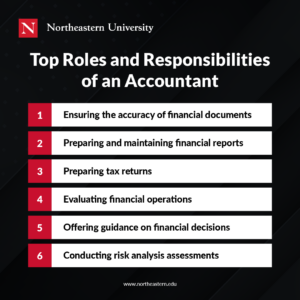

When it involves the ins and also outs of tax obligations, accounting and money, nevertheless, it never injures to have an experienced expert to rely on for assistance. An expanding variety of accounting professionals are additionally caring for points such as cash money circulation estimates, invoicing and HR. Inevitably, a number of them are tackling CFO-like roles.When it came to using for Covid-19-related governmental financing, our 2020 State of Small Company Research located that 73% of tiny service proprietors with an accountant stated their accounting professional's guidance was essential in the application process. Accountants can likewise aid local business owner avoid costly mistakes. A Clutch survey of tiny organization proprietors programs that even more than one-third of small companies list unexpected costs as their leading economic obstacle, complied with by the mixing of business and personal finances and the inability to receive payments on schedule. Local business owners can expect their accounting professionals to aid with: Selecting business structure that's right for you is necessary. It affects just how much you pay in tax obligations, the paperwork you require to submit and also your individual responsibility. If you're seeking to convert to a different organization structure, it could lead to tax consequences and also other problems.

Even business that are the same dimension as well as sector pay really different quantities for accounting. These expenses do not tax consultant Vancouver convert into money, they are necessary for running your business.

The 9-Second Trick For Small Business Accounting Service In Vancouver

The ordinary expense of accounting services for little service varies for each special scenario. The average month-to-month accounting costs for a tiny business will climb as you add a lot more solutions and the jobs get harder.You can record transactions and process pay-roll utilizing on-line software program. Software application options come in all shapes as well as dimensions.

:max_bytes(150000):strip_icc()/GettyImages-1126511626-72ceb797e9664d05bcb2f7e0a8914b8b.jpg)

Small Business Accountant Vancouver for Beginners

If you're a new company owner, don't forget to variable bookkeeping prices right into your budget. If you're a professional proprietor, it may be time to re-evaluate accountancy costs. Administrative expenses as well as accountant costs aren't the only accounting expenses. Vancouver accounting firm. You should likewise consider the impacts accounting will certainly carry you and your time.Your ability to lead employees, offer consumers, and choose could endure. Your time is also important and also ought to be considered when looking at accountancy expenses. The time invested on bookkeeping jobs does not generate earnings. The less time you invest in bookkeeping as well as taxes, the more time you have to grow your organization.

This is not meant as legal suggestions; to find out more, please click on this link..

Vancouver Accounting Firm Fundamentals Explained

Report this wiki page